Non-Fungible Tokens: the New Realm of Cryptocurrency

April 28, 2022

Imagine a world where instead of buying a piece of artwork you see at a museum, you buy a digital file of it. This has now become reality with the rise of NFTS. A non-fungible token (NFT) is a digital asset that allows digital content to be bought and authenticated on a cryptocurrency blockchain.

NFT blockchains, primarily Ethereum, are ledgers that record transactions and are distributed across an entire network of computer systems on the blockchain. This system makes hacking and alteration of data impossible, accounting for the authentication of NFTs. Each NFT has a digital signature that doesn’t allow for them to be exchanged for something else of equal value.

Though they’ve been present online since 2014, NFTs are now starting to gain popularity because they allow individuals to buy and sell digital work. They are one of a kind due to unique identifying codes. But, numerous NFTs already exist on the internet as video clips or GIFs.

Regardless of the initial price, an NFTs value is completely based on what another individual is willing to pay for it. Therefore, demand for a specific NFT will increase the price rather than the price to create the NFT.

Vedant Talati ‘25 shares his opinion on the risk of owning NFTs.

“NFTs are exploding in popularity, and while this may seem like a lucrative endeavor, the reality is that it is incredibly tough to break into the market. I don’t recommend owning NFTs as an EHS student,” Talati said.

Even though investments in NFTs are relatively new ventures, understanding the use of these digital assets in larger contexts is critical. In some cases, cryptocurrencies based on blockchain technology serve as a threat to a government’s control of monetary policy and financial resources. On the other hand, there are several advantages to this technology to raise funds for the nation.

For instance, the Indian Budget Provision allows the Indian government to define NFTs, differentiating them as “virtual digital assets.” Essentially, there are three parts to this plan:

- The government has the authority to determine what is or is not an NFT. Each NFT would have to undergo a thorough certification process.

- The government will verify categories of NFTs. Some of these groupings will be based on historical events, influential individuals, etc.

- The government still has the power to declare that an object is not an NFT. Essentially, they have the authority to choose, determine, or classify a digital asset as an NFT.

Various forms of cryptocurrency are being explored by other governments: China, Japan, the United States, the Bahamas, the European Union, Ecuador, Venezuela, etc. Investments, in general, are tremendous risks and governments may abuse their power to make profit.

Nicholas Heisler ‘22, a student from the Financial Literacy class taught by Economics and Personal Finance teacher Ms. Lynne Tierney, shares his opinion.

“In Venezuela, it’s a big issue because they’re investing 320 million dollars in cryptocurrency machines, but they’re cutting over 100 million to education and health care,” Heisler said. “They’re completely disregarding the people just to make more money. It’s also super hard to trace because it’s not regulated like traditional stocks are, and it’s easy to use it for illegal activities and to transfer money around.”

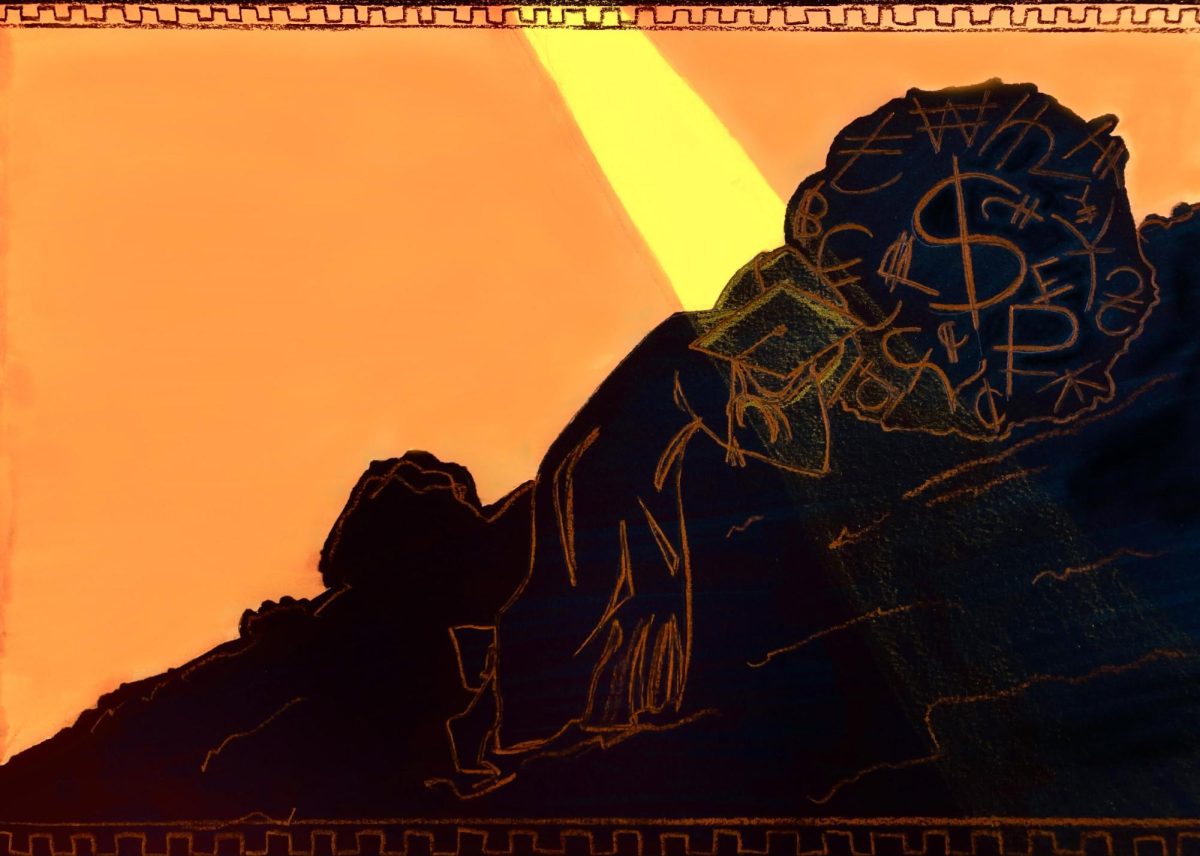

Different types of NFTS can be acquired by mining tokens, which is the same process used to create Ether and Bitcoin. Miners are encouraged to use cheap forms of electricity to maximize profits; however, the mining of NFTs contributes to large amounts of e-waste. Since NFTs require transactions to bid, pay, or transfer ownership, they are associated with high levels of electricity consumption. Creating digital art can leave a tremendous carbon emission footprint, signaling vast effects on the environment.

“…I hear a lot on the news about NFTs and crypto being bad for the environment. On one hand, the short-run use of fossil fuels is causing pollution,” Tierney said. “On the other hand, the high energy requirement makes it expensive to mine tokens, and that reduces fraud. In the long run, however, I believe the high cost will give miners an incentive to look for cheaper energy sources. This may end up reducing the pollution problem.”

Considering all the negative impacts of NFTs, one may wonder if NFTs should be purchased, especially as a student. Although they have great potential in business and technology, NFTs are risky investments and are not completely reliable. Investing in these items does not always result in success because the value of an NFT fluctuates based on the market. EHS students who are interested in these items should research the NFT collection they are looking to purchase and analyze its history.

It is clear that NFTs contain many flaws that can harm the economy, environment, and the business-tech world. Nonetheless, these tokens may lead to an individual or business amplifying their profit margins. NFTs truly represent new advancements in cryptocurrency.